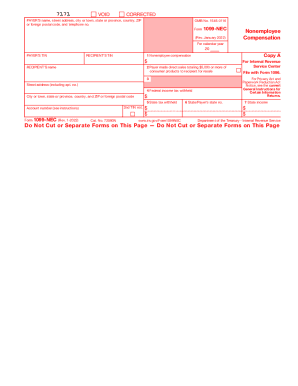

MD Comptroller MW506NRS 2023-2024 free printable template

Get, Create, Make and Sign

Editing mw506nrs online

MD Comptroller MW506NRS Form Versions

How to fill out mw506nrs 2023-2024 form

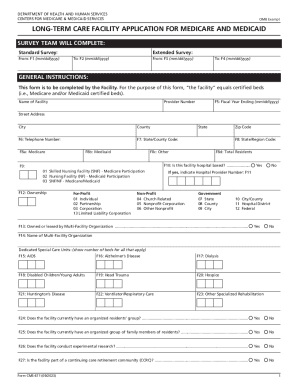

How to fill out md return tax property

Who needs md return tax property?

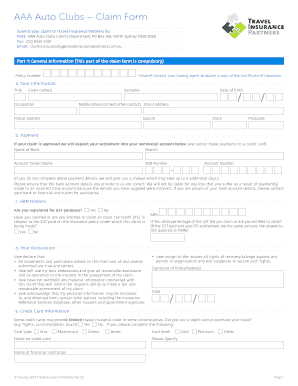

Video instructions and help with filling out and completing mw506nrs

Instructions and Help about maryland mw506nrs form

Though we've just finished up the annual liaison meeting compliance division MAMBA state tax committee Eros Monday, September 20th at 900 am we were introduced by Brian letters our committee chairman to the state officials those that are intended swear Sharma Bernard director of the compliance division and her deputy director Daniel Riley as well as some assistant directors Lynn Hall Robert Sir Ben Miller as well as some people from the audit division Betty Scott and Tom Carr delay Fallon the assistant chief auditors as well as some individuals from here in heels Deborah Norman and child Zephyr Brian introduced us as well as thank the individuals in attendance and their assistance in putting this together as well as being so SEC's accessible to us during the year for our taxpayers as well as for their representatives the state members went into some summaries they had some items on their agenda the first and foremost they discussed the mist program which is about a year or so into the progress they started out they said that this is going very well that this should also intensify collection proceedings and compliance as well from taxpayers in Maryland currently this year there was about 47 million dollars that was taken in by the state of Maryland sixty-seven million dollars overall and initially this was budgeted over the first three years to I need 7 million dollars, so they're about 7580 percent coverage of the collection that they thought they would get over a three-year period in just a little over a year they also mentioned that there would be a large data warehouse as a part of this program currently it only holds federal IRS data but over the next six months they are going to start Li starts to slowly input state information from different divisions that should be a manual process over the next six months again over the next year or two this is going to take significant resources from the state as far as time and money, and they said that should be about one to two years with an additional three one two years after that of smaller resources, so we're looking at additional three to four years of implementations for this myth's project progress they also went into the Maryland state amnesty program and how the that have that actually was last October initially budgeted about sixteen million dollars to this amnesty program they actually took it about thirty million dollars with ten million dollars in collections they're waiting for a final report which should be doing the next month or two on how the overall outcome of the program I guess happened as far as their expectations they also had an update on court cases recently settled court cases over the last year those to be of interest was the Johns Hopkins in a case as well as the hot air balloon a named case feel free to go out on their website to check out that information they also responded some to some questions from the committee which included a breakdown of the current auditors...

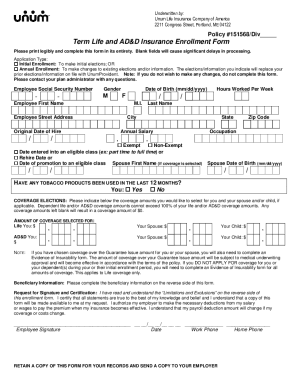

Fill maryland nonresident : Try Risk Free

People Also Ask about mw506nrs

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your mw506nrs 2023-2024 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.